The mission of Project Poseidon is to capture maximum upside from higher oil prices over the medium term. The Trident Trade expresses this thesis through three components, all highly levered to higher oil prices, each with a different angle and risk profile. Embedded in the thesis is the assumption that for the duration of this trade, shale will not be coming back. Higher prices incentivise more production and if these additional barrels will not be coming from shale, they will come from somewhere else. One such place could be conventional discoveries with low breakevens such as Pantheon Resources (PANR). Another place with greater upstream investment going forward should in my opinion be offshore oil. Some observations supporting this assumption:

offshore breakevens have decreased by ~50% over the last five years (Fig 1)

are now among the most cost-competitive methods of oil generation (Fig 2)

and discoveries are coming off a very low base (Fig 3).

Fig 1: Offshore breakevens over time

Fig 2: Offshore breakevens in comparison

Fig 3: Offshore exploration

Why offshore drillers

When drilling offshore, producers enlist the services of offshore drillers that own the drilling rigs used to extract the oil for a certain day-rate. Essentially an oil services industry, drillers go through their own capital cycle, tied to the oil cycle with a lag. The industry is notorious for destroying capital and has undergone two restructuring waves over the last five years (first 2016/17, then 2020/ongoing). I believe offshore drillers are ripe for a cycle turn. The last five years in offshore have been marked by an oversupply of rigs that in many cases were contracted at unsustainably low day-rates and at low utilisation. A recovery appeared to be underway in 2019 before demand cratered once more during the pandemic in 2020. This has accelerated three supply-side dynamics that make me think the outlook for the industry is more constructive going forward. Offshore drillers have

de-levered (mostly through restructurings entailing debt for equity swaps)

consolidated (e.g. Noble merging with Pacific Drilling while in bankruptcy, Noble and Transocean/Dolphin both bidding for bankrupt Seadrill’s assets)

scrapped a lot of older rigs.

While currently still a lot of stacked rigs sit on balance sheets, some of these have merely been kept around as part of the assets to secure debt against. With much of this debt overhang in the industry now eliminated/equitised, companies have less incentive to hang onto these unproductive assets. Hence, there is probably more scrapping and consolidation to come over the next year or two, shifting the balance of power away from producers in favour of drillers when it comes to contract terms. Once a sustained recovery in day-rates and utilisation is underway, offshore drillers stand to profit in a big way. The company I have singled out to form the last leg of the Trident Trade is Transocean (RIG).

Why Transocean

Although the majority of commentators I follow and FinTwit (financial Twitter) appear to favour the companies recently emerged from bankruptcy (Valaris, Noble, Diamond Offshore) due to their de-levered balance sheets, I think it is going to be RIG that will offer the maximum torque amongst offshore drillers. By virtue of being the only major player not to default, RIG boasts the highest debt load (net debt of about USD6b vs market cap of about USD2.5b) in the industry. A large portion of RIG’s outstanding bonds trade (significantly) below par, implying a non-zero chance of default. This technically leaves equity with option value only. Should the company, as I suspect, be able to avoid restructuring, this is the part of the capital structure that will enjoy the most significant re-rating.

I have singled out RIG because the company

have sufficient liquidity to survive until the cycle turns

have executed on a disciplined fleet transformation over the past six years (more below)

focus solely on the ultra-deepwater (UDW) and harsh environment (HE) space, which is currently experiencing the strongest recovery out of all offshore sub-sectors

have the one of the most modern fleets of UDW/HE floaters and will be the first company to operate eighth generation drillships that will command the highest day-rates.

Financial and operating highlights

There was an excellent write up done on RIG a few months ago. While not up to date in all aspects, the essence of it remains unchanged.

Refraining from excessive modelling, I believe it makes sense to look at a few crucial things:

debt load and maturity profile

liquidity position

contract backlog

Total debt sits around USD7.5b with maturities as seen below. Major maturities begin in 2023 with about USD0.5b and maturities greater than USD1b in each of 2024 and 2025. Looking at how the company has reduced debt over the last couple of quarters (USD300mm in H1 21 - focus on shorter maturities) and factoring in current liquidity of about USD2b, this leaves up until about the end of 2023 for the thesis to play out.

Fig 4: RIG debt maturity profile

Liquidity (see Fig 5), same as contract backlog (see Fig 6), has been in a steady decline for the past couple of years. This drain was largely due to the industry-wide oversupply in rigs leading to lower fleet utilisation and lower day-rates post 2014/15, hurting cashflows.

Fig 5: RIG liquidity over time

It will be crucial for the company to turn around their contract backlog bleed and to begin adding more contract volume than is rolling off each quarter. The aforementioned industry-dynamics of consolidation and scrapping will be one factor influencing utilisation and day-rates. Another one will be the fleet age and composition of individual companies, i.e. what sub segment (if any) they focus on.

Fig 6: RIG backlog over time

Fleet composition and transformation

During the last cycle a lot of rigs were ordered as demand rose, only to hit the market at the peak in 2014/2015. Thereafter the oil market cratered, rigs were in oversupply and few rigs have been delivered since. As mentioned on the outset, 2016/17 marked the first restructuring wave in the industry and companies had to transform their fleet to stay afloat. Transocean was no exception and since then the company has

significantly reduced the size of their fleet through scrapping and divestment of non-core assets

added modern drillships through targeted acquisitions (albeit with unlucky timing)

thereby halving average fleet age

while narrowing focus on floaters (see Fig 7 below), UDW and HE in particular.

Fig 7: RIG fleet transformation

RIG current fleet breakdown

Today, RIG’s fleet is composed of 29 UDW and 10 HE floaters. Of the 29 UDW floaters, 18 are currently contracted (incl. two newbuilds entering service in 2023), 10 are stacked, and one is idle. I would expect the drillships currently not under contract not to be re-activated anytime soon. Furthermore, some of the older drillships currently under contract but with contracts maturing in 2021/22 will possibly be stacked and might eventually have to be scrapped.

Of the ten HE semi-submersibles, eight are under contract until well through 2022, the majority of which have an option to be extended further. The two remaining ones were stacked last year and due to their age, I assume they will not re-enter service.

Peer group fleet comparison

To understand why I think that RIG’s fleet will be able to command the highest day-rates within UDW/HE it makes sense to look at the fleet composition compared to some of its competitors. Looking at Fig 8 below it can be seen that RIG has not only the by far largest fleet of UDW floaters, the company also owns four times as many drillships that entered service after 2014 compared to its peers.

Fig 8: RIG vs peer group UDW fleet comparison

These newer drillships have thus far been contracted at markedly higher day-rates than older, lower-spec drillships and this spread is expected to widen going forward. Deep Value Driller AS (DVD NO), a Norwegian, single-asset company essentially builds part of its investment case around this thesis. First evidence of this can be seen in the day-rates for the Gulf of Mexico. In a slide shown by Transocean at a September 2021 conference, it can be seen that not only are day-rates ticking up (as well as number of fixtures), but also that RIG fixtures lie consistently above those of competitors (see Fig 9). In addition, RIG’s two newbuilds (Deepwater Atlas and Deepwater Titan - expected to enter service in 2023) have both been awarded contracts that will earn day-rates of around 450k USD.

Fig 9: Gulf of Mexico fixtures

UDW/HE market outlook

Even though more scrapping and consolidation are expected going forward, improving demand will play an equally important role for the thesis to play out. Altana Capital, a London based asset manager with a dedicated offshore oil and gas fund, recently held a webinar during which they described the current state of the offshore sector and its recovery. To their surprise, the UDW/HE segment is currently enjoying the strongest recovery - partially due to having endured the harshest downturn prior. Offshore analytics provider Esgian is observing the same in the below presentation on the deepwater segment. If you have the time I encourage you to watch them both.

Variant perception

The emergence from bankruptcy has left RIG’s competitors in relatively better financial condition due to the elimination of debt. A deleveraged balance sheet and trading at lower level vs replacement cost of fleet have been cited as main reasons for people to prefer e.g. VAL over RIG. Admittedly, lack of financial leeway gives RIG less flexibility for acquisitions (inability to raise debt at non-punitive terms, equity as only “currency” in a deal) and puts a countdown on the thesis. If the recovery won’t play out as expected, RIG will likely have to restructure at some point. If, however, supply continues to tighten while demand continues to normalise, RIG should offer substantial torque due to

the combination of financial and operating leverage

owning the largest, most capable fleet of modern, high-spec UDW drillships.

By placing too much emphasis on leverage (which can cut both ways) and where a company is trading vs replacement value of assets (ignoring superiority of RIG fleet) it is mainly this that I think the market is sleeping on.

Valuation and possible upside

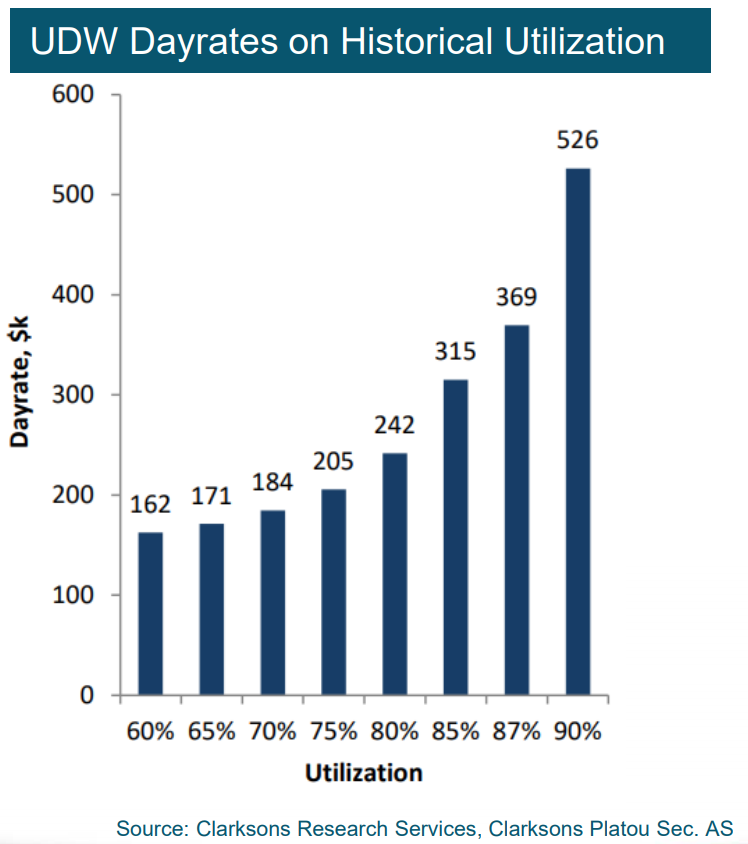

In order to get an idea of how high day-rates can go, a look at what has historically been achieved can serve as a guide. Fig 10 below shows day-rates as a function of historical utilisation.

Fig 10: Historical UDW day-rates vs utilisation

Using the above as a starting point, and assuming EBITDA margins gradually increasing from currently 35% to 45% at 90% utilisation, a rough, back of the envelope calculation yields the following possible outcomes for returns.

Fig 11: Return scenario analysis from current levels

Based on current market conditions, the assumptions resulting in returns >200% (bottom right corner of Fig 11) might appear overly bullish. In 2014 however, when RIG last earned day-rates in excess of 400k on aggregate on their UDW fleet, the company

achieved >90% utilisation on UDW at higher fleet age

at ~50% EBITDA margins

while being valued well in excess of 7x EV/EBITDA.

These numbers are not to be taken at face value but do a good job at illustrating just how much RIG is geared to higher day-rates.

Conclusion

RIG is a high-risk, high-reward play on a substantial recovery in the UDW segment of offshore drilling. The company is highly levered but possesses a clear edge over their competitors by operating the largest, most capable fleet of modern drillships. In addition, management has proven adept at weathering challenging market conditions and avoiding restructuring up to this point. Given my view of higher oil prices over the medium term, I am confident the cycle has turned for this industry. My money is on RIG as the fastest horse on the way up. This makes it the last prong in the trident, completing the trade.

Thank you for reading,

LazCap

NOT FINANCIAL ADVICE

The information contained on this Website and the resources available for download through this website is not intended as, and shall not be understood or construed as, financial advice.